When I started talking about for-profit Ministry, I received several messages asking, “How can a ministry be for-profit?” Aren’t you supposed to focus on serving God instead of making money?

The term for-profit, which is used for tax purposes, tells taxing agencies you plan to make a profit and pay your taxes. However, it does not have boundaries that block you from other goals that fulfill your ministry’s purpose.

If you’re asking, “How can a ministry be for profit, consider these important points. Cultural indicators are flashing signs saying that ministry will look different in the future. The way we conduct ministry is changing. It is just a matter of time before new regulations and requirements take the non-profit status over the top. Where we minister and how we minister will look different in the future. These changes require new strategies that, if executed prayerfully, will open new opportunities to reach more people–exactly what God desires. Acts 1:8 says:

“. . . But you will receive power when the Holy Spirit has come upon you; and you shall be My witnesses both in Jerusalem and in all Judea, and Samaria, and as far as the remotest part of the earth.”

Let’s inspect the Bible verse using the Bible Scrolls Study Method to decode the passage.

The disciples questioned Jesus about the future and His kingdom. He told them it was not for them to know the time (Acts 1:7), but they would receive the power they needed to be His witnesses.

Here is what the passage tells us:

- The Holy Spirit brings power.

- We receive power,

- We use that power to be God’s witness in places that are near and far.

In this verse, the word receive has a root that means “to lay hold of.” When we decode the verse, it tells us we are supposed to lay hold of the power of the Holy Spirit to help us share the good news about God to people who are near and far. Acts 1:8 tells us to be witnesses everywhere we go.

Marketplace Ministry is a great opportunity to follow God’s Word and “go” reach people. The call is the same no matter where you are, at work, church or home. Making a profit does not remove the Christian responsibility to share your faith. However, it does create an expanded opportunity to “show” your faith in business and other arenas.

While the for-profit model is more challenging for some ministry areas, there are ways to find sources of income when the financial gifts fall short.

For example:

- A writer earns a profit for selling books even if the subject is Bible study.

- A speaker charges for traveling and delivering a speech no matter what he talks about. The ministry is in the speech content and the relationship with the audience, not the paperwork.

- You can be an insurance agent, a CPA, a store owner, a chef, or any other business owner, and make it your ministry.

- As an educator, sometimes I teach Bible study, I have a YouTube channel, I speak at church events and business conferences about honor, passion, and creativity at work. No matter where I speak, there is a fee that helps me care for my family and personal expenses. When I get paid, I take out a portion of taxes because I have made a profit. I use other portions of the income to pay business and ministry expenses.

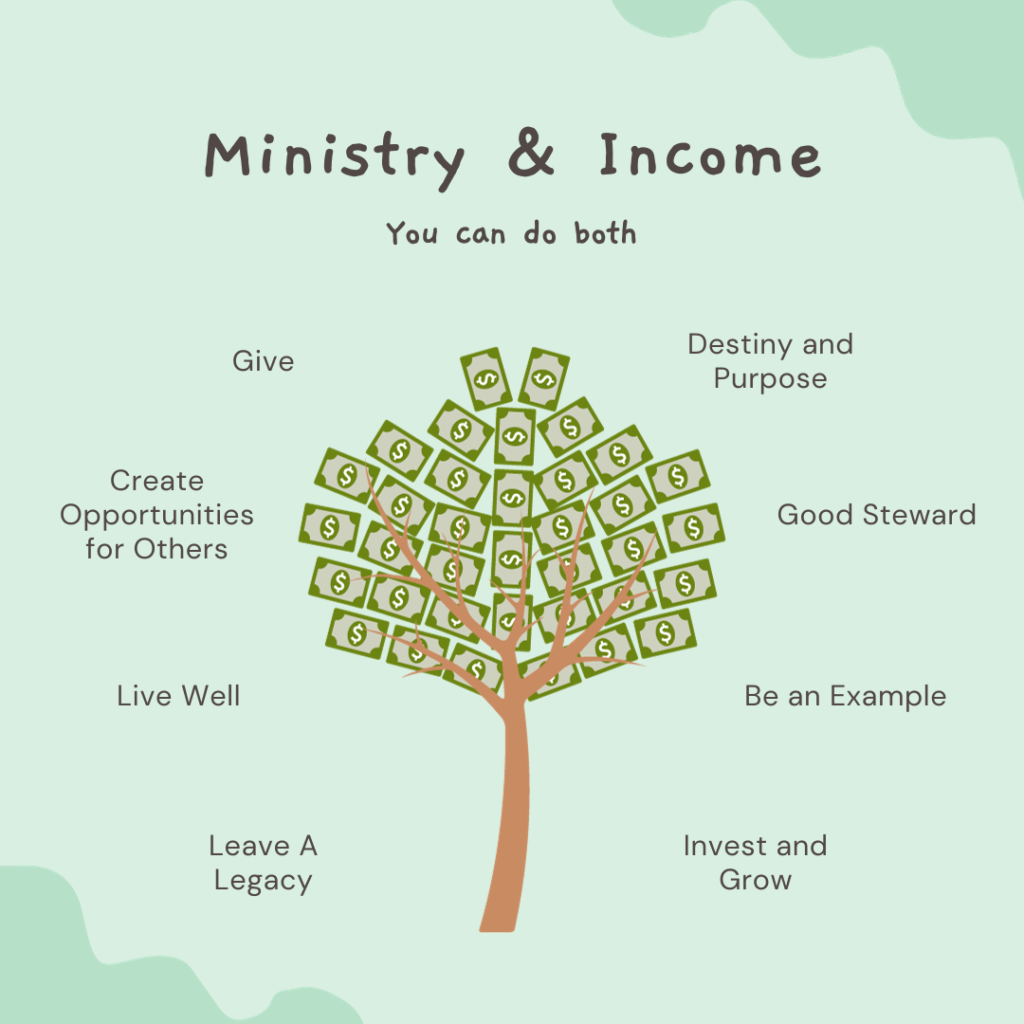

Making money does not negate a genuine call to ministry. It just means you have a responsibility to be a good steward with the money you make.

Most of us are used to a stereotypical model of ministry — you quit your day job, ask for donations, and try to manage financially. That stills works in some circumstances, but for many people in ministry, that model leaves you far short of the money you need to support your family and lifestyle. Why live by the restrictions of requiring donations to fund your lifestyle when you can activate your creativity and do both–earn the money you need and fulfill your ministry call.

Convinced? Here’s how it works.

First, make sure you have a clear vision of what you are called to accomplish in ministry. Then, select a business that accommodates your business while providing the space needed for your ministry to flourish. Also, get valuable tools from my book How to Make Your Business Your Ministry Finally, take some time to browse through the posts in this site for more details about setting up your ministry as a “for-profit” organization.

Most importantly, spend some quality time in prayer. Ask God to show you how to grow your business and fulfill your ministry call. Twenty-four hours, seven days a week, is a lot of time if you use it wisely. Once you know your business and your ministry, it is all about learning, planning and using resources such as the Small Business Administration.

It is hard work, but the joy of knowing that you have landed in the bullseye of God’s plan, maximizing your gifts and talents and fulfilling your God-given call is worth every minute.

Yes, a ministry can be for-profit as long as profit is not the primary goal. The for-profit ministry is just a status for tax purposes that provides the freedom to soar in all your gifts and abilities while creating an avenue for financial security.

Go ahead, jump out of the box, and use everything that God gives you. Serve well and enjoy the journey.

Like what you are reading? Take the next step and get connected.

- Click on “Grow With Us” below and get new articles, videos and resources.

- Get the Book: How to Make Your Ministry Your Business and discover life-changing Marketplace Ministry principles that catapult you forward.

- Look for our upcoming online coaching opportunities.

Hi Valencia, It’s such a blessing to know that God is calling you. Even when it seems uncertain, we trust that God is able to see us through what He calls us to do. It sounds like you need some time to make some important decisions. For now, are you able to start somewhere? I have found that making a move and doing the ministry gives you the insight to make more decisions. For example, can you start making videos on social media? Can you name your ministry, get a DBA and start as a sole proprietor? As long as you know the message God is leading you to share, there is no reason to wait. Then, when you start making money, depending on how much, you can make the additional decisions.

I hope this helps get you started. I have said a prayer for you. I know God will guide you. Please tag me on your videos so I can see you. @rhondawwilliams – Blessings!

Thank you Rhonda for your transparency. I’m called to ministry, I have served on many jobs and the more I seem to move in God, jobs faint. I don’t know how to begin; if I should create an EIN for nonprofit or 1099. My goal is to launch on social media and speak at events. Will that be 1099 and take out taxes? I don’t believe I need ZenBusiness, if so, please share your thoughts. I have no employees.

P.s

I’m glad I found your page. Very helpful!

Hi five to you for starting a ministry. My company uses ZenBusiness.com for legal documents like LLC. There are also attorney offices that specialize in getting those document done. Do a Google search and you will get lots of information. Also visit the US Small Business website. I Hope that helps.

I am looking at starting a for-profit ministry. The ministry will be structured in raising money by fundraising, donations, and giving. Majority of the funds will be used to support other ministries, churches, special community projects, etc.

The other expenses will be used for salaries, company expenses, like web design, marketing, creative design, etc. We are expecting to be managing large sums of money, and wondering how to setup and structure the company legally? LLC, 501c3, etc?

I doesn’t matter. The business model protects you personally, determines how you operate and handle taxes. You can follow guidelines for all of the models and still function as a ministry. I have an insurance business as a sole proprietor and a publishing company as an LLC. But the goals, relationships and how we interact with clients line up with my ministry (Ministry in Business). Even the money (from speaking and coaching) is reported as income to the IRS. I hope that helps.

I just had one question, one sort of business models are good to incorporate a for-profit ministry? sole proprietorship, s-corp, LLC?

Thank you!

Great article!